"Monetarism creates a constant state of austerity."

"By default, asset holders become richer and

wage-earners become poorer." Hector Wetherell McNeill McNeill McNeill |

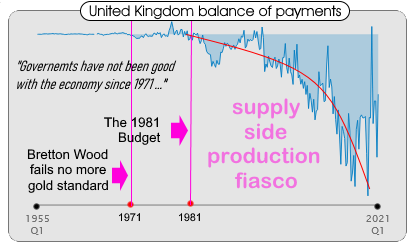

According to Hector McNeill, the recent book by Clara E. Mattei, "The Capital Order" points out an important fact concerning the use of austerity to manage the macroeconomy under monetarism. The reasons for this default status of austerity is that the Quantity Theory of Money, the go-to justification for monetary decisions concerning inflation, ignores the degree to which assets remove significant amounts of money needed by the productive (real) economy. There is a default state facing the 40% of the middle to lower income groups in the United Kingdom of facing increasing income disparity and poverty. This is a direct result of the difference between goods and services markets which make up the bulk of wage-earner's cost of living and the asset markets which constitute the source of wealth and income for asset holder and traders who make up a minority of the population. This is explained in more detail in Note 6 of the British Strategic Review series entitled, "The constitutional crisis created by monetary policy". Most QE funds flowed into assets robbing SMEs and industry of funds resulting in falling investment, productivity and wages while asset holders simply purchased assets and without any additional effort their value increased while some even added to this by earning rent. The original "justification" for austerity was to save the pound and balance of payments. This mission failed completely with the period 1975 through 2022 seeing the UK's balance of payment in goods plumetting to the world's second worst position. However, austerity has continued to be a default policy component that now protects the value of a range of assets and a small group of constituents who are asset holders and traders (less than 1% of the constituency - see Box 3). |

|

|

UK Corporation UnlimitedIn effect, the British economy was managed somewhat like alarge corporation with constituents being the work force whose wellbeing was ultimately dependent upon the decisions of the "managers", or government of the day. Initially economic growth in a country like Britain was reflected in the state of the exchange rate of the pound (£) and the balance of payments. Therefore labour costs were considered to be the fundamental factor in determining competitivity. So any declines in the balance of payments or in the value of the pound (£) was considered to be a productivity issue linked directly to costs and therefore labour wages. Therefore taxation was used to depress both domestic consumption by lowering disposable wages and interest rates were raised to attract purchase of pounds in savings accounts to raise the value of the pound. The result of this policy was to severely lower the real incomes of wage-earners while raising the incomes of those with financial capital to deposit in banks.

This process of a "tight" fiscal and monetary policy imposed a condition of

"consume less and work more for less" also referred to as austerity.

AusterityClara E. Mattei has identified this policy as a specifically British phenomenon in her book, "The Capital Order" in which she

Mattei Mattei |

describes aspects of the proceedings of the 1922 Genoa Conference on Finance which, from her account, appears to have been dominated by British contributions. In Chapter 6 entitled, "Austerity, a British Story" she shows that the view of participants, considering that imposing austerity had social agitation and instability risk implications. It was more appropriate to impose such a policy through non-political and "independent" central banks based on decisions taken by "expert" technocrats. This would furnish governments with plausible deniability of responsibility on the basis of a displacement argument that the best economic theory and practice was being applied through "leading experts". Thus decisions were considered to "not to be questioned". Thus having independent central banks would remove political and public oversight and control over monetary policy and decisions on degrees of austerity applied.

With the advent of universal suffrage and the notion of voters deciding which political party manifesto to support, this central bank independence issue has resulted in monetary policy never being part of any party manifesto.

This topic is a taboo, only to be meddled with by the esoteric unelected experts in the bowels of the Bank of England.

Thatcher Thatcher |

Brown Brown |

Gordon Brown the insurance agentIt is the view of the economist Hector Wetherell McNeill, Gordon Brown made the Bank of England independent as his first Act in 1997 to avoid the fiasco that doomed the Thatcher government which was the massive repossession of homes resulting from that government's imposition of high interest rates.

Brown wished to avoid the same calamity for Labour.

The Aggregate Demand Paradigm Macroeconomic policies since the Keynesian "revolution" have regarded "aggregate demand", measured as the volume of money circulating in the economy, to be the driver of economic growth. This was based on the notion that government could avoid the problem of unemployment and depression experienced during the 1930s following the New York Stock Exchange collapse in 1929.

During the period 1945 through 1965 Britain had an unprecedented rate of real economic growth with rising real incomes, high investment, productivity growth, falling income disparity and full employment.

"Inflation is not a monetary phenomenon."

"It is a productivity-pricing phenomenon" Hector Wetherell McNeill

According to Hector McNeill, Friedman never seemed to be very good at understanding mechanisms. McNeill refers to his undergraduate training at the University of Cambridge School of Agriculture, in which students were required to create farm plans for operational farms to lower costs and raise profits. This resulted in the build up of a good appreciation of the factors that determine prices. Besides the weather, production and feasible prices depend on input costs, the selection of production techniques and degrees of optimization with the objective of minimizing production costs to maximize real incomes. Farmers who innovated and adapted were able to lower their unit costs and could earn a good living while selling at competitive prices, accessible to families on the range of existing disposable wages. Farmers who were less skilled or who lacked capital, operated at higher costs and had lower real incomes. No matter the volume of money in the economy, this had no effect of output costs or prices because farmers were in competition.

Later, when studying policy at post-graduate level, at the School of Agriculture, the farm planning know how was an essential resource to link to policy design. In this way policy designers could understand to what degree policies could provide incentives for farmers to innovate so as to encourage lower priced production and contain any inflationary tendencies based on rising productivity and stable or even falling feasible prices.

The lesson learned was that inflation is not a purely monetary phenomenon but is, rather, a productivity-pricing phenomenon.

While studying post graduate economics at Cambridge and Stanford Universities, McNeill noticed that by far the most illogical subject was monetary theory and policy especially in relation to inflation. He found that lecturers and professors, like Milton Friedman, could not explain the mechanisms that create inflation as a result of money volumes. Every time he asked the response was for the respondent to write the Quantity Theory of Money on the white or black board as an explanation. McNeill observed that this never constituted an explanation because the productivity factor is not there, as well as something like 10 other essential factors (variables).

|

|

|

Keynesianism was not applied because there was full employment.

Friedman Friedman |

Kaldor Kaldor |

By 1970 the monetarist concepts promoted by Milton Friedman who assumed that issuance of money, created demand and therefore economic growth was shown to be erroneous by Nicholas Kaldor. In 1975 McNeill noted that Friedman was unable to explain the mechanisms of how money volumes create inflation. The best he could do was to assert that

"It happens in the long term" which, according to McNeill is not a mechanism.

Money everywhere Healey Healey |

The OPEC petroleum price shocks starting in 1973 resulted in a long phase of stagflation (rising inflation and unemployment) and Keynesianism and Monetarism proved to be unable to manage this issue. Whereas austerity had been applied to manage the £ exchange rate and balance of payments, the application of monetary "solutions" saw the £ exchange rate against the dollar fall by around 50% and balance of payments decline to the second worst globally between 1975 and 2022. The issue was and remains the fact that British international competitvity has been declining for about 40+ years and continues to do so. 1975 was the pivotal year since it was when Denis Healey opted for monetarism as the principal macroeconomic policy paradigm. The scourge of austerity was introduced and was intensified under conditions agreed with Johans Witteveen the MD of the IMF when Healey requested an unnecessary IMF loan. The reason it was unnecessary was that the Treasury had overestimated the borrowing requirement.

The emergence of specific counter-stagflation policiesAround 1975 there emerged two specific policy initiatives designed to tackle stagflation.

Mundell Mundell |

One came to be known as "

"Supply Side Economics" (SSE) developed largely on the basis of the work of the Canadian economist Robert Mundell a professor at Columbia University, New York.

McNeill McNeill |

The other approach was developed as

"The Real Incomes Approach to Economics", also referred to as "

Real Incomes Objective" (RIO), by the British economist Hector McNeill now Director of the George Boole Foundation.

In reality SSE doesn't have much to the supply side since it is a fiscal policy with lower marginal tax rates for high income bands. The theoretical, and somewhat naive, concept was that by releasing more funds to higher income groups this would result in more investment and a rise in productivity thereby countering inflation. This was attempted by

the Reagan and Thatcher administrations but also combined with high interest rates. In both cases the government deficit rose, income disparity rose as a result of corporate owners and executive pocketing the windfall tax rebates gained from the policy. There was some inflation reduction associated with this period but this seemed to be more related to a depressed market while some selected technological advances contributed to raised productivity.

By contrast RIO was designed to ensure that corporate taxation was related to productivity increases measured in terms of demonstrable operational productivity increases and more moderate price increases but on a profitable basis. In practical terms companies only receive tax concessions as a result of actual performance results as opposed to the common practice of non-quantifiable productivity gains or price benefits associated with, for example, "super-deductions" tax concessions. The system would rely on real productivity rises in wages linked to productivity deals. Thus the real incomes growth component relates to a more comprehensive support of the real incomes of company owners, workforce and consumers in an increasingly competitive market.

Wright's Law & Moore's LawWright's and Moore's Laws are fundamental relationships that are major contributors to productivity growth through the reduction in operational costs, reduction in consumption of materials and power and therefore provides a foundation for lowering unit prices of output and thereby kill inflation and augment wage purchasing power.  Wright Wright |

Theodore Wright was an American aeronautical engineer who discovered the learning curve, the ability of individuals to become highly competent in carrying out repetitive tasks leading to less mistakes, less waste, using less material and time to produce given output resulting is a lowering of unit costs of production. Today, this is an advanced applied quantitative management technique for calculating the future unit cost trajectories for process production. Wright discovered this relationship by analyzing the data on airframe production and published his results in 1936.  Moore Moore |

Gordon Moore was an engineer dealing with integrated circuits who predicted, in 1965, that the number of transistors or logical primitives that could be packed into an integrated circuit would double each year. This is apparent in the constant miniaturization of circuits packed with increasing digital logic taking up less volume and reducing the associated material resources required, consuming less energy and subject to falling costs and consumer prices.

See Tacit & Explicit Knowledge

|

|

|

McNeill's objective was to gain sustainable real growth making use of such the existing quantitative relationships that deliver a constant growth in productivity subject to Wright's and Moore's Laws. See box on right.

RIO was never applied but we will return to its operational design to explain how it operates later in this content.

Petrodollar, money no object & MMT

Witteveen Witteveen |

The rise of the circulation of petrodollars was the result of Johans Witteveen's initiative to borrow OPEC dollars to provide IMF loans to low income countries to purchase petroleum. This soon spilt over into the private sector financial intermediaries using massive volumes of petrodollars to lend on. Rather than discourage petroleum price hikes, as desired by Nixon and Ford, Witteveen's actions helped OPEC continue to raise petroleum export prices, thereby exacerbating global stagflation.

Basically, centred on the New York Mercantile Exchange (NYMEX) domination of the petroleum petrodollar market the spin off was large hedge funds less concerned with balance of payments or the value of the dollar or, even less, the value of the pound, but more interested in the purchase and sale of assets including those rolled up into derivatives.

This money-based logic saw the growth of a different perspective on the origins and role of money in the economy and the role of government in this process. One outcome of this was the emergence of what is called today Modern Monetary Theory (MMT).

This has been taken up by a small group of economists who have regarded the issuance of money as being a purely legally established government-controlled issue without the need for bond sales or people's savings and that taxation would be the means of removing excess funds from circulation to control any inflation.

One of the unfortunate associated narratives has been that the notion of banks lending on to borrowers using deposited funds placed there by savers, for example under fractional reserve banking, does not exist. Well, it did exist, but now there are different means of raising money from thin air as explained in an article entitled,

"Money creation in the modern economy" in the Bank of England Bulletin published in 2014.

If we step back through this evolution we end up with coins whose value was linked to their precious metal content. These, of course could not be created out of thin air, just as previously, savings could not be. The well established building society or mortgage providers, operated for centuries based on the saver-loan principle. Many credit unions today in many countries continue with this model.

The other bizarre assertion by some MMT advocates is that taxation was always believed to be a means of raising revenue for governments as opposed to being an instrument to control inflation. McNeill has stated that this is not true in that in policy studies and statements made in the 1960s did see taxation as a way to curtail inflation as well as raise revenue. The balance here was achieved through the weighting of progressive taxation bands.

McNeill has pointed to the main problem with MMT is that it remains part of the aggregate demand paradigm, along with Keynesianism, Monetarism and Supply Side Economics. As a result there remains the perennial failure of Keynesians, Monetarists and, it would seem, MMT enthusiasts to explain:

"Monetary policy is based on a flawed logic."

"This is the Quantity Theory of Money."

"But this is completely illogical" Hector Wetherell McNeill Fisher Fisher |

According to Hector McNeill, the commonly applied Quantity Theory of Money identity proposed by Irving Fisher, doesn't represent the factors that determine the prices of goods and services according to money volumes. The Quantity Theory of Money (QTM) identity by Irving Fisher is as follows:

M.V = P.Y ..... (i)

Where, M is the volume of money; V is the velocity of circulation; P is the average price of goods and services; Y is the quantity of goods and services purchased or real income. The Real Money Theory (RMT) identity by Hector McNeill adds in 10 missing variables:

(M-(l+r+p+m+a+h+f+c+o+s)).V = P.Y ..... (ii) Where, l is land; r is real estate (homes, commercial & industrial sites); p is precious metals; m is commodities; a is rare art objects; h is shares; f is other financial assets (e.g. derivatives); c is crypto-currencies; o is overseas monetary flows; s is savings. The Cambridge EquationThe Cambridge University economists John Maynard Keynes, Arthur Pigou and Alfred Marshall attempted to improve the QTM but only progressed as far as adding savings (s) to the QTM. This created what became known as the Cambridge Equation.

McNeill advanced this work far further by integrating all of the additional factors that determine volume of money that actually impacts the prices of goods and services in relation to total money volume. These additional factors all absorb money and reduce the proportion of money going into goods and service transactions. The RMT represented above indicates that these additional factors remove and continue to rotate funds within what are referred to as "encapsulated asset markets" causing more significant price rises in these markets than in goods and services markets where competition exists. Where these assets with inflating prices are used as significant wage-earner or commercial needs, such as land and real estate, then this inflation leaks into business costs and household cost of living. As a result, McNeill's RMT identity represents a more complete and accurate identity than the QTM. This box contains a simple explanation based on a baseline version of the RMT. Since its elaboration in 2020, the RMT has been increasingly refined to serve as a decision analysis model to simulate monetary policy instrument effects at the Strategic Decision Analysis Group a unit within SEEL-Systems Engineering Economics Lab. Austerity has become a default state under monetarismWhereas the current discussions surounding austerity regard this as an instrument to be applied under conditions of inflation, McNeill has demonstrated that, in reality, the continuing rise in income disparity under monetarism, has resulted in austerity becoming a default state for an increasing proportion of the British population. The British Strategic review has explained his position in its Note 6 "The constitutional crisis created by monetary policy"

Reference: British Strategic Review, Note 11, "Monetary Deception", 2022. |

|

|

- How money volumes increase inflation

- Why is austerity still the proposed solution through raised taxation to lower inflation

Along with many other economists McNeill has questioned just how governments assign issued funds because to date the track record has been one of benefiting assets holders and traders and prejudicing wage-earners.

The need for real growthIn 1976, McNeill conceived of the real incomes approach to economics. Here such indicators as inflation are replaced by real incomes. So in the case of the examples of the MMT model of the economy as being a bath tub into which the government can pour money and then drain it away in the form of taxation to control inflation, is not realistic. This is because inflation, which is also the devaluation of the currency, is not caused by money volumes but by input costs. MMT assumes that if production rises at the same rate as money volumes there will be no inflation.

That might be true, but what is important is the purchasing power of the currency. So if we compare two states of the economy both of which have the same level of production. Real growth is not the same growth referred to as economic growth by aggregate demand paradigm economists. Their notion is that if money volume increases are matched by equivalent volume increases in production then there will be no inflation. McNeill showed that this was not true simply because inflation arises as a result of rising input costs and even although production might be the same, profits and ability to maintain employment at current wages becomes impaired and inflation follows. By taxing or varying interest rates to correct this type of inflation only depresses the economy.

McNeill's work during the stagflation crisis demonstrated that the reason Monetarist and Keynesian aggregate demand policies failed was that the instruments (money issuance, interest rates and taxation) applied were designed to control demand pull inflation when the actual situation facing the world was cost-push inflation.

The only way to handle cost-push inflation is input substitution and changes in production methods and technique to lower unit costs. This can only be secured on the basis of physical productivity changes (more-from-less) and more competitive pricing made possible as a result of lower unit costs.

Competition, productivity and real incomesNo matter how much money is in the economy most companies are in competitive markets. Therefore the main determinants of unit prices are the levels of disposable incomes in the buying clientele and the elasticity of demand of products produced. For comparable products, those with lower prices sell more than those attempting to sell at higher prices. Therefore under conditions of rising money volumes there can be no effect on unit prices because any particular production group is in competition with other producers. Where there are rises in input costs, the companies adjusting more rapidly through input substitution and changes in technology are those who will reduce their unit costs and, as a result, will be able to out compete those who do not undertake such changes. Thus, those companies which are more competitive as a result of increased productivity and lower unit costs end up with higher real incomes. However, because they are selling at relatively lower prices they impact consumers by augmenting the purchasing power of consumers. Therefore, they help increase the real incomes of customers and the nation.

It is this type of virtuous cycle that initiated the growth in the British industrial revolution with people designing new artefacts and machines, learning by doing, refining techniques and moving in the end to create markets of sustained consumption based on mass production.

Although the notion of globalization existed centuries ago under the general title of mercantilism, the accumulation of cash from exports by Britain, once regarded to be the workshop of the world developed during the nineteenth and began to falter in the early twentieth century. However, the boost from petrodollar loans, after around 1977, led to an acceleration of offshore investment and a downturn in onshore investment.

Jean-Baptiste Say (1767-1832) Say Say |

In 1831, the French economist,Jean-Baptiste Say an industrialist and champion of Adam Smith published his "

Economic Treatise", with the subtitle of "

The Production, Distribution & Consumption of Wealth". In this he described a model of an economy that reflected exactly how Great Britain was to develop following the opening of the Stockton to Darlington railway in 1825. He explained that as engineers and people developing new devices in an entrepreneurial process of using resources in an increasingly efficient manner led to an ability to pay workers more so as to generate demand arising from such wages. This virtuous circle saw the growth in multiple industries and manufacturing enterprises, a rise in agricultural mechanization enabling more food to be produced by less farm workers and the rise in an urban industrial working class. The key point was that by maintaining a balance between profits and wages the economy grew on the basis of demand arising from the increasing consumption of the working class. The Keynesian concept of aggregate demand based on finance or government borrowing did not exist and growth arose from learning by doing and the constant refinement of technique and increasing efficiency or productivity. As can be seen, growth was based on productivity and corporate price setting at levels affordable to domestic industry and consumers.

The rapid expansion of the economy, although involving capital investment from wealthy, usually landed individuals, was maintained by a balance between the rate of increase in wages that created a rise in consumption. This was made possible because unit prices of essentials remains within bounds as to make them accessible to the population. As a result domestic demand was an important driver and this rested on production systems paying adequate wages. This system was by no means perfect since income disparity was high and often increasing. However, a large number of artisans and very small initiatives and businesses led to the emergence of a middle class whose incomes were rising.

Hector McNeill has explained that this growth relied upon a fine balance between evolving productivity and price setting enabling Say to link wages in the productive sectors to the levels of consumption.

Therefore demand, in the modern sense of this word, arose from a combination of rising productivity and appropriate price setting. Note that this has nothing to do with modern notions of aggregate demand which pay no attention to productivity or price setting but only look at the monetary dimension of money volumes from any source including finance and average prices. It is this highly abstract notion of demand that led contemporary economists to discount Say's model and to discredit the fact that production and wages received create the demand for the production involved. Put another way, Say based demand on the real productive economy whereas monetarists base it on an inexact notion of money volumes in the economy. The basic contrast between Say's entrepreneurial model of the growth economy and monetarism is the emphasis under monetarism on the accumulation of wealth in assets and rentier activities which have little connection to the productive economy.

The real incomes approachOne of the results of McNeill's analysis of the stagflation period was the development of "The Real Incomes Approach to Economics" which takes the Say model emphasis on productivity and price setting as the principal motor for sustainable development. This is a completely different policy paradigm to the Aggregate Demand (AD) approach but is rather, in line with Say's model an approach which is based on the supply side Production, Accessibility & Consumption paradigm (PAC). Note that McNeill has replaced Say's treatise subtitle word "distribution" with the word "accessibility". This refers to price product accessibility in terms of unit prices, physical delivery and to support. This substitution focuses any derived policy on the factors affecting the cost of living for the existing range of wages. By identifying policy instruments that provide incentives to counter inflation through productivity and pricing the real incomes approach is designed to tackle inflation. After all it was first identified in 1976 in the middle of a serious stagflation crisis. This adoption of the PAC paradigm makes the real incomes approach quite distinct from the AD paradigm which, in reality, has a very poor track record.

The track record of PAC as an operational basis is present in the economic growth records of the British economy since the mid-nineteenth century. As stated the motor for this globally significant expansion was the productivity-price relationships that determined the real incomes or purchasing power of wages.

Wainright Wainright |

McNeill describes the reaction to this proposition in his Botequim section of

his website (March 26th, 2020). The dominance of the AD approach and in particular monetarism, meant that when McNeill circulated a copy of the very first edition of

Charter House Essays in Political Economy describing a real incomes policy proposition to the Conservative, Labour and Liberal party representatives in 1981 there was little constructive response.

Matthews Matthews |

William Wrainright the Liberal Party Economics Spokesperson was one of the few to take an interest and clearly understood the concepts. However, he also realized the radical nature of the proposition. His reaction was that,

"If we proposed this in our manifesto and we won the election, we would then be faced with having to implement it!" McNeill has noted that he received a lot of useful critiques which he used to improve the policy. By far the most useful feed back came from Professor Robin Matthews during a review meeting at Clare College, Cambridge which McNeill stated was very valuable helping to turn the policy into a general macroeconomic policy rather than one limited to just containing rising inflation. The Labour party pointed McNeill to a meeting with Len Murray at the TUC which was a dead loss; he didn't seem to understand the issues.

Changing timesWith the advent of universal suffrage in the United Kingdom the application of austerity as an instrument of monetary policy ended up creating political movements to represent the interests of the wage-earners in industry and the main political force arising from was the Labour party. The Labour Party emerged from a rapidly growing union movement after 1890. Labour formed an alliance with the Liberal Party to gain cross support in elections, ending up with a small number of MPs in Parliament up until the 1920s, when it split from the Liberals who were in decline.

Clara Mattei in her excellent book has described parallel movements of worker associations developing alternative economic organizations to escape the repetitive and almost constant imposition of austerity.

Most gaps in economic provisions & an imposed quasi permanent state of austerity resuting from increasing income disparity & poverty are the result of monetarism.

Monetarist variants all risk the same outcome.

Attention needs to be focused in incentives to raise productiity & to moderate or reduce prices to generate sustainable real economic growth.

Hector McNeill |

Some were relatively successful which troubled owners of assets including financial capital so an intentional depression of the wage economy began resulting in wage-earners resorting to risky means of enhancing income. One symptom was the New York Stock Exchange Collapse in 1929, heralding the Great Depression.

Change over from productivity-based growth to aggregate money based growthUp until the end of the nineteenth century the operation of the economy in Britain followed, in a rough manner, the Say entrepreneurial growth model based on a rising level of productivity in industry and manufacturing. By this time,productivity in the USA was overtaking that in the United Kingdom with the rising US domestic market and natural resources. However, imprudent oversight of banks and a spate of high risk lending to invest in stocks and bonds resulted in share prices exceeding by far any relationship to the true profitability of companies and a sudden loss in confidence resulted in the Stock Exchange Crash followed by the Great Depression and high unemployment. Although the cause of the Crash was irresponsible lending and an asset bubble collapse in seeking aspects of economic theory to blame Say's model was identified as being unable to ensure employment. This was not the case but for now let us leave the reason that was not until further on in this story.

Coming out of the Depression, Germany facing excessive reparations following the Triannon Versailles Agreement at the end of the First World War its democracy became an easy victim to the Nazi movement under Hitler, just as Italy succumbed to the Fascist movement under Mussolini and we entered the Second World War. Observing the New Deal in the USA with government borrowing and outlays being used to generate employment, in 1936 John Maynard Keynes published his book, "

The General Theory of Employment, Interest & Money".

Rather than concentrate on productivity and pricing Keynes looked to government borrowing and assignment of funds to employment creating activities as a means of securing full employment. After the experience of the Great Depression, employment levels had become a fixation with policy makers as well as political parties representing workers. Because of the impact of the General Theory and unreasonable criticisms of Say's model, including by Keynes, any policy initiatives geared towards productivity and price moderation incentives were not even considered. The war had demonstrated what governments could do when they controlled finance by building the tools of war so Keynes' suggestions fell on fertile ground.

Although accepted as the new Aggregate Demand paradigm, it is paradoxical that in the post-war 20 year period between 1945 and 1965 no Keynesian policies were applied. This was because, paradoxically, both in the USA and Britain investment by private and nationalized industries rose along with productivity affording rising real wages and falling income disparity. Growth was unprecedented. Robin Matthews studied this period and found that in spite of a deflationary monetary policy the economy has grown without any discernible applied policies. McNeill has observed that this was the last time the Say Model operated in the United Kingdom. Soon after this period an economic crisis arising from the 1973 OPEC petroleum price hikes saw world wide stagflation and the rise of the petrodollar. In Britain monetarism and the Aggregate Demand paradigm came into force in 1975. Therefore in essence the Production, Accessibility & Consumption model died out between 1929 and 1945 as a result of a terrible depression and two wars and it existed for a short period between 1945 through 1965. Beyond that period we entered the world of monetarism and the Aggregate Demand paradigm.

Real growth and money growth - there is a significant differenceOver the last 40+ years when economists speak of economic growth they tend to refer to the percentage increase in the volume of money in the economy taken up in transactions, or Gross National Product. There is therefore, a confusion in assuming economic growth is measured by the increase in GDP from one year to the next, or quarter by quarter.

The Say model, or RIO (Real Income Objective) model, used by the Real Incomes Approach, is focussed more on the content of goods and services that the money volume in the economy supports. These reflect the real output of the economy and what people can consume reflecting a measure of standard of living or real income.

The Aggregate Demand (AD) Paradigm Failures

Keynesianism, Monetarism, Supply Side Economics, and as far as is known so far, Modern Monetary Theory, possess no instruments able to provide positive incentives to encourage and enable companies to become more physically and price efficient. Simple equating different levels of money volumes with to equate similar levels of production because the real product and service content can be different as can associated margins, prices and wages. The additional confusion is that the Quantity Theory fails to distinguish between goods, services, 8 assets cklasses as well as savings and overseas flows as described in this content (see Box 3).

If one reviews the foundation texts of Keynesianism, Monetarism, Supply Side Economics the handling of technological change and innovation is at best cursory, if mentioned at all.

As far as is known Modern Monetary Theory does not handle innovation and productivity in an adequate fashion simply because this domain has emerged from a monetarist and Keynesian foundation.

Such things a tacit and explicit knowledge are ignored and entrepreneurship, today, seems to be restricted to business leaders as opposed to the work force and innovation tends to be more associated with long term academic institution research projects.

However, given the state of the economy and the degrees of income disparity there is a need for polices that deploy instruments able to bring about immediate change. The AD policy instruments of interest rates, taxation and money volumes did not work during the last energy-related stagflation and no new instruments have since been developed within those policy domains, For this reason they cannot address the needed changes required to regain adequate real growth on a sustained basis.

In 1971,

In 1971,

McNeill

McNeill Mattei

Mattei Thatcher

Thatcher Brown

Brown Friedman

Friedman Kaldor

Kaldor Healey

Healey Mundell

Mundell McNeill

McNeill Wright

Wright Moore

Moore Witteveen

Witteveen Fisher

Fisher Keynes

Keynes Pigou

Pigou Marshall

Marshall Say

Say Wainright

Wainright Matthews

Matthews